Buy Verified Paytend Accounts

$320.00

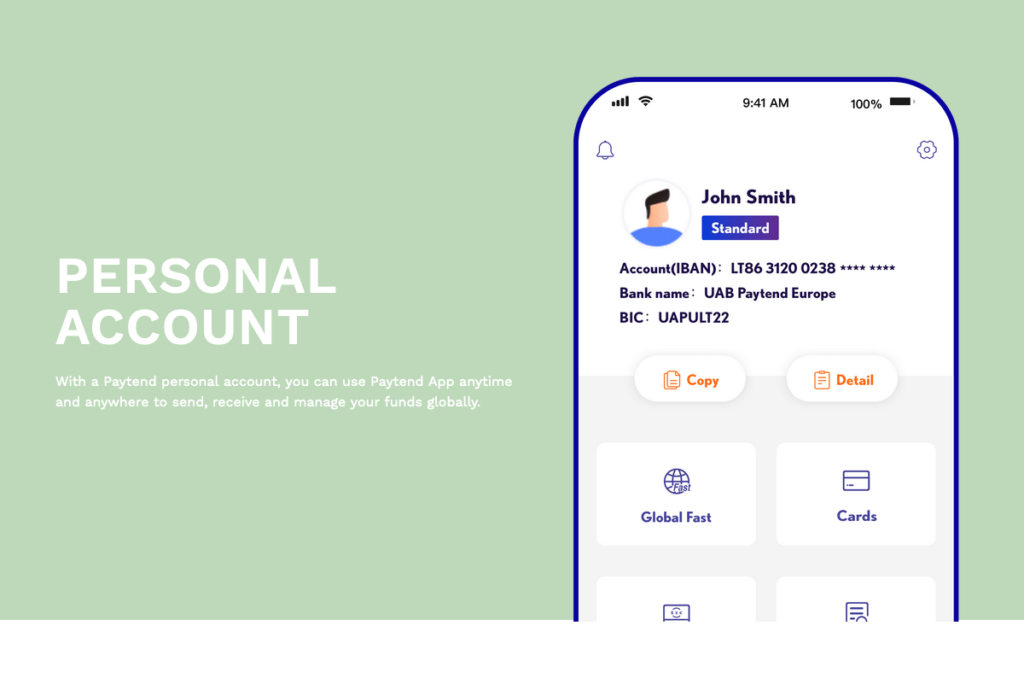

Experience seamless global transactions with Buy Verified Paytend Accounts & personal IBAN, supporting over 30 currencies for effortless international payments.

Orders NOW!

- Satisfaction Guaranteed

- No Hassle Refunds

- Secure Payments

- Fast Delivery

- 24/7 Dedicated Service

Description

Buy Verified Paytend Accounts

managing your finances has become much more efficient thanks to the latest payment options. One platform that has received the attention of many is PayTend Accounts. With a variety of services, PayTend accounts have been specifically designed to make online payments such as money transfers, managing finances more efficient. This article will look at the features of PayTend accounts are, how they function and how they can be an excellent option for businesses and individuals alike.

PayTend accounts are PayTend accounts is a financial online service that provides digital payment options, such as money transfer, bill payment, and international transfer. It works similar to other mobile payment options offering users an easy way to manage their money without the requirement of traditional banking. PayTend accounts is well-known for its focus on simplicity access, safety and flexibility.

Benefits of buy verified Paytend account

Verified PayTend accounts grants you a variety of key benefits, such as greater functionality, security, as well as access to a wider selection of banking services. Verification is a crucial step for those who wish to make the most of their experience with PayTend accounts.

Here’s a list of the top benefits that come with having your account verified account at PayTend accounts:

1. Higher Transaction Limits

One of the major advantages of confirming Your PayTend Accounts is an increment in the limitless transactions. Accounts that are not verified often have limitations on the amount that can be transferred or received. After you have completed your verification, the limitations are drastically increased and allow you to transfer more of money without having to worry about exceeding a limit.

2. Increased Security

Verification provides an additional layer of security for your account. PayTend accounts makes use of documents of identification and personal data to ensure only authorized people have access to and access the account. This reduces the chance of fraud and unauthorised transactions giving peace of mind to users.

3. Access to All Features

PayTend accounts provides a range of services, including international cash transfers, bill payments as well as debit cards that are prepaid. However, certain of the services are available only to authentic customers. When you verify the account you have created, you gain the full accessibility to PayTend’s collection of financial tools, making sure that you utilize this platform at its fullest potential.

4. Faster Transactions

Verified PayTend accounts usually benefit from quicker processing times. When you send money, particularly internationally, verification can speed up the process of making payments, allowing for faster transfers and less delays. This is especially important when you are making transactions that require time or when sending money to friends and family.

5. Improved Customer Support

PayTend accounts provides premium customer service for users who are verified. If you encounter any problems with your account, or require assistance in completing transactions, you’ll receive quicker and more efficient customer support. This will ensure that any issues or issues are dealt with quickly.

6. Lower Fees

Accounts with verified PayTend accounts typically have lower transaction costs compared to accounts that are not verified. This is especially advantageous for those who perform frequent transfers or pay for services, since the lower costs could translate into significant savings over the course of time.

7. Ability to Link More Payment Methods

If you have a verified account you are able to connect additional payment options, like multiple debit or bank accounts. This allows you to select the most efficient and convenient method of funding your account or make transactions.

8. Eligibility for Premium Features

Verification can also give the ability to access premium services, or exclusive discounts. This may include special offers as well as higher potential for earning from loyalty programs or access to additional tools for financial management specifically designed exclusively for verified customers.

9. Conformity with Regulatory Standards

Verification of your account ensures that it is in compliance with the rules governing financial transactions, like the anti-money laundering (AML) as well as know-your-customer (KYC) guidelines. This is particularly important for those who wish to transfer large amounts of money or participate in international transactions. This assures that you are operating in accordance with the legal guidelines and helps avoid account freezing or other problems.

10. Peace of Mind

In the end, having a verified PayTend accounts gives security. You can rest assured that your account is secure and you can utilize the features of the platform for managing your money, pay and transfer money. The added verification process decreases the chance of fraud and also adds a security layer.

Verified Paytend Accounts For Sale, with the highest quality and KYC all over the globe

Verified Paytend Accounts For Sale, with the highest quality and KYC all over the globe

Purchase Paytend verified accounts with us, and we will provide the top KYC accredited supported region you’ll need. If you’re in search of authentic Paytend accounts to purchase, then you’ve come to the right place. We have a reliable network of partners around the globe to provide KYC verification for all kinds of accounts. We will always supply accounts- identification photo and ID, and photo, email access as well as access to phone numbers and everything you require to protect your account and gain access. So don’t be late when you require and would like to purchase now.

What are the benefits of buying verified accounts with paytend?

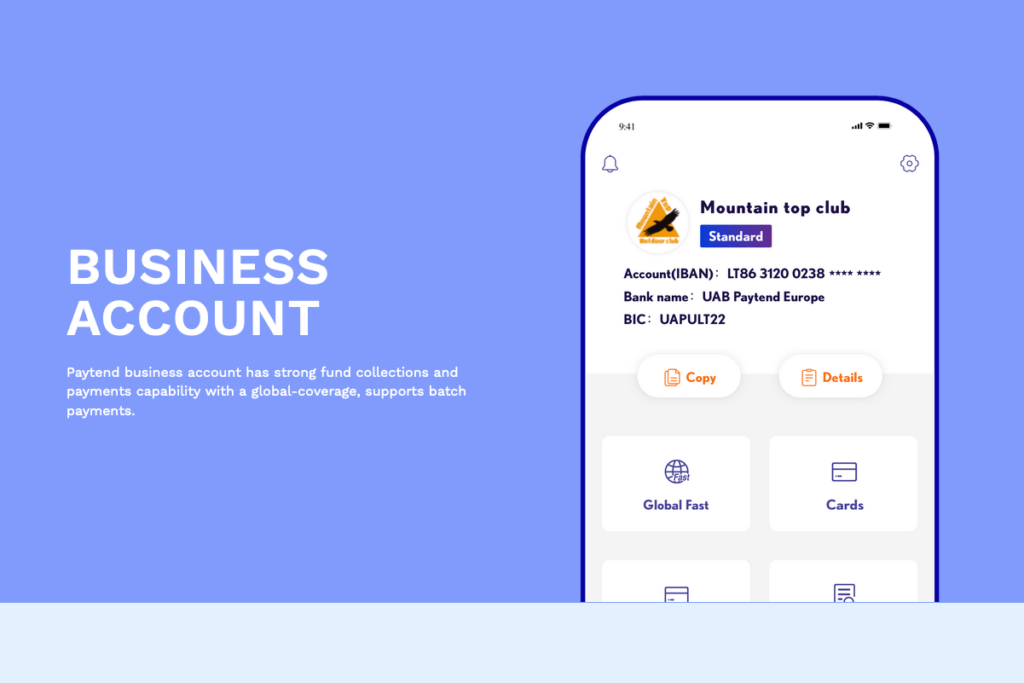

PayTend accounts provides a broad range of services that help you manage your finances, arranging payments and transfers of money more efficient. If you’re a person looking for a straightforward method to transfer money or a business proprietor looking for a reliable payment method, PayTend offers the tools that you need.

1. Send and Receive Money

PayTend accounts lets you send money to family, friends or companies, both locally as well as internationally. When you have to pay off a debt or send a gift or transfer funds to a person overseas PayTend accounts can make it simple and speedy. You can transfer funds using your debit or bank account or other linked payment methods.

2. International Money Transfers

One of PayTend’s most distinctive features can be its capability to make international cash transfer. If you’re paying for items or services, transferring money to relatives in another country or investing in international markets PayTend accounts guarantees speedy safe, affordable, and secure payment across borders.

3. Bill Payments

With PayTend accounts you are able to conveniently pay for a wide range of bills from your bank account. This includes utility bills and credit card charges as well as mobile phone payment as well as insurance premiums and many more. It is possible to set up automatic payment to prevent late charges and late due dates.

4. Prepaid Debit Card Integration

PayTend accounts gives you the option to add the debit card of a prepaid account with your existing account. This card is able to be used to make online purchases and in-store purchases as well as ATM withdrawals. This is a good option for those who want to limit your spending, or don’t want make use of your banking account to make online transactions.

5. Top-Up Your Mobile Phone

You can make use of Your PayTend accounts to replenish phones on mobiles, which makes it simple to get credit for calls, data or texts. Simply connect the number of your mobile phone to your PayTend account, and manage your balance on mobile using the application.

6. Buy and Sell Digital Currency

Certain PayTend accounts provide the option to purchase exchange, sell or trade digital currency (cryptocurrencies). This is a straightforward and safe way to trade or invest in cryptocurrency directly from your account at PayTend, according to the services offered in your particular region.

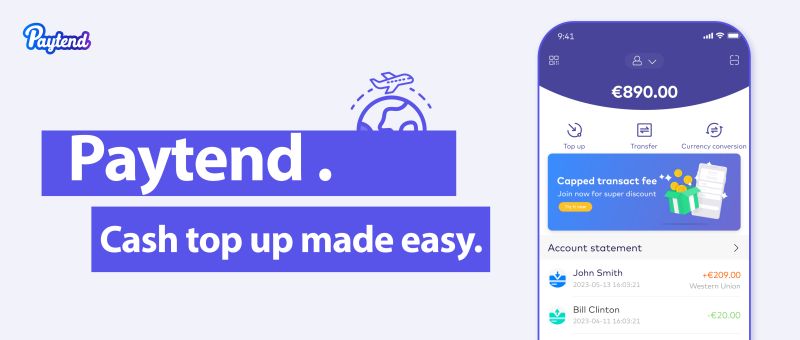

7. Track Your Expenses and Transactions

PayTend accounts comes with tools that aid you in tracking your expenditure, making it easier for you to control your spending. You can look up transaction history as well as categorize your spending and track your financial activity in real time, giving you more control over your finances.

8. Peer-to-Peer (P2P) Payments

Pay instantly to anyone who has an account on PayTend, making it ideal for splitting charges, sharing expenses, or making an instant payment to a person. The peer-to-peer transfer method is easy and effective and ensures that money gets to its destination swiftly.

9. Link Multiple Bank Accounts

It is possible to connect different debit and bank accounts with PayTend accounts, allowing the flexibility to fund your transactions. This allows you to transfer funds and pay bills, as well as manage your finances through the same platform.

10. Request Payments

With PayTend accounts you can make payment from other people. This is particularly useful for freelancers, small companies or those who need to collect payment for goods or services. Send a request for payment and the recipient can conveniently pay you through the PayTend accounts they have.

11. Earn Rewards or Cashback

Certain PayTend accounts holders could be eligible for rewards like cashback, loyalty points if they utilize specific features or make certain kinds of payments. These rewards can be used for promotions, discounts, or other rewards.

12. Manage Multiple Currencies

If you have to make international payments, your PayTend accounts can manage multiple currencies from your account. This is particularly beneficial for businesses or individuals that require payments in various currencies or who engage in trade with international partners.

13. Mobile App Management

The mobile app for the PayTend accounts offers users with a fully efficient interface to manage their money on the go. If you’re checking balances, transferring funds or managing your bill payment and other payments, you can manage it all using your mobile.

14. Access to Financial Insights

PayTend’s financial tools provide customers with insight into their spending habits and financial activity. This is a useful feature for people seeking to improve their budgeting, or gain more insight into their spending behavior.

15. Customer Support and Dispute Resolution

PayTend accounts offers support for customers to assist with any concerns or disputes about transfers, payments or setting up your account. Customers who are verified have access to specific support channels that guarantee quicker resolution of any issues.

Are you searching for a Paytend authentic paytend account to purchase ? You’re in the right place to find top-quality KYC Paytend accounts.

KYC is a term used to describe a procedure that banks and financial institutions employ to collect the identifying information and contact details from potential and current customers. The purpose of KYC is to stop money laundering, fraud and other illegal activities as well as use of accounts for financial gain.

1.) If you are planning to make an order so in the event that you meet the requirements for eligibility, you need to first sign up as a user. You can sign up for an account as a standard user by submitting the email you use to sign up.

2.) If you wish to have to have a company with a all the capacity, to meet internal and legal compliance requirements, we’ll have to require two steps to create an account:

- A) the posting of a individual or company’s material to the platform; and

- B) to be a signatory to the decision-making document signed by the directors of the business on the issue of the application of the company.

3.) After receiving identification data the employees of the company will verify the information by requesting relevant documents. The proper documentation for identification verification may include the following, but not limited to the following:

- A) for an employee who is an individual Copy or high-resolution image of the passport page or other identity document from abroad, including the last and first name, date and location of birth and passport number, date of expiry and issue, country. of the printout, and the signature of the person who is using it. Paytend account might ask you to upload a quality selfie with a the hand ID and notation (for Paytend.com) in order to verify that the user uploaded the document in person and submitted the document solely for Paytend.com.

- B) for a business owner A high-quality document that proves the existence the business, such as an official registration document, and in the event of the certificate of name change or a valid certificate, the articles of incorporation. Certificate issued by the government. Business license (if required) certificate issued by the government, business license (if applicable). c) to confirm that the customer’s address is correct, the business requires at least one of the following be supplied, in the same name as the client: a top-quality document proving utility bill payments (telephone water, electricity, etc.) and is released at the end. 3 months; copy of rate or tax bill from the authority local to. bank Statement (for current account or deposit account, or credit card balance) A copy of the bank statement.

The user must be in agreement with KYC management and supply any information or documents that are required by their company.

- The company may deny any employee’s services with permission following that time, and without having to provide the reason for decision-making.

- If the automated procedure fails, the business will notify the user via email or other methods to collect the details and documents.

If the user fails to submit the required documents on the form requested, and all other information needed to complete this KYC verification within fifteen days that aren’t holiday days in Seychelles at the demand by the Company, Paytend may reject/ban it. An employee.

Additionally the issuer has the right to either partially or totally release the proceeds from any claims or losses that the issuer may incur. Any transfer fees or fee for fiat money or for cryptocurrency are the obligation of the customer.

Why decide to purchase a an authentic Paytend account?

Why decide to purchase a an authentic Paytend account?

Here are some more information about every one of the following reasons:

Competitive rates:

We provide competitive rates when purchasing Paytend account as we strive to provide the most choice that our users can get. We realize that you’re faced with the option of choosing when you are looking to purchase a Paytend account and we’d like to make sure that you choose us since we can provide you with the most competitive price.

Purchase the best Paytend accounts

We offer the best Paytend accounts, with the highest KYC services. If you are looking for a low-cost safe, reliable and secure Paytend account, there is no better choice than us. We do not stop selling and provide after-sales service until customers’ complete satisfaction. So, if you’re thinking of purchasing a Paytend account, make sure you confirm your purchase and receive instant access to the top KYC Paytend account.

Secure and safe platform:

We utilize a variety security measures to guard your personal information, such as the use of encryption and fraud prevention as well as two-factor verification. We take security seriously and wish you to have confidence that your transactions are secure when you do business with us.

Speedy and efficient:

We handle transactions fast and efficiently due to the fact that time is crucial to you. It is our goal to ensure that you receive access to your Paytend account as soon as you can, which is why we strive to ensure the transaction gets processed as fast as we can.

Good reputation:

We have earned a reputation for offering excellent customer support. We know that purchasing a Paytend account is an overwhelming task, so we’d like to ensure that you are satisfied. We’re always there to answer any questions you may have and assist you with the transaction.

100% money back guarantee:

We only offer product guarantees, other than 72 hours or three working days guarantee on money back.

Available 24/7:

We are always available to answer any questions you may have and assist you with your transaction. We know that you might require the purchase of a Paytend Account at any point of the day or night which is why we ensure that we’re there to assist you.

We hope that this article will be of help. For any additional concerns, do not be afraid to reach us.

PayTend FAQ: Everything You Need to Know

If you’re thinking about making use of PayTend or are a member, then you may be unsure regarding the way that the platform functions. Here is a list of commonly asked queries (FAQs) to guide you through the PayTend experience.

1. What is PayTend?

PayTend is a digital payment service that lets users to transfer money, pay bills transfer funds across borders manage prepaid cards and much more. It is designed to make managing money easier through providing a quick and secure method of handling transactions.

2. How do I set up an account with PayTend? PayTend account?

To set up a PayTend Account Simply:

- Install the PayTend account application through on the Google Play Store or Apple App Store.

- Launch the app and select “Sign Up” or “Create Account.”

- Fill in your personal information including names, emails and telephone number.

- You can verify your identity through submitting valid government issued ID along with evidence of address, if required.

3. Is PayTend safe?

It is true that the PayTend accounts use the latest encryption technology and measures of security to safeguard your financial and personal data. PayTend adheres to global security standards such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to ensure secure transactions.

4. What are the advantages of confirming my PayTend accounts?

Confirming your account on PayTend accounts can bring you many benefits:

- More transaction limits are set for money transfer and receipt.

- Access to additional features, like international transfers, prepay cards.

- Security and protection increased to your accounts.

- Lower transaction fees.

- Faster transaction processing times.

5. Can I transfer money internationally using PayTend?

It is true that the PayTend accounts support international currency transfers, which allows the transfer of money to more than 100 countries. It is possible to send money to your family and friends or purchase products and services worldwide, usually at affordable rates.

6. What kind of bills can I pay PayTend accounts?

With a PayTend accounts, you can pay various bills direct through your account, such as:

- Costs of utilities (electricity, gas water).

- Mobile phone top-ups.

- Credit card charges.

- Insurance premiums.

- Payments for loans, and much more.

There is a possibility that PayTend Accounts charge fees when using specific services for example, transfer of money and currency. However, the charges are usually competitive and less than conventional banks. The fees may differ based on the kind of transaction (local as opposed to. internationally) and the method of payment employed (bank account debit card, bank account. ).

8. What is the time frame to finish a transaction?

The time to transfer depends on the nature of the transfer:

- Local transfers generally last for minutes or even hours.

- International transfers can take anywhere from between a couple of hours and several business days, based on the country of destination and the payment method.

Verified users usually have faster processing speeds.

9. Can I utilize PayTend without connecting to a bank account?

Although linking an account with a bank or debit card to the platform makes it more flexible, the PayTend accounts is also able to accept alternative payment methods, like prepay cards or other financial services that are linked to it. You are able to still transfer money and make payments, but certain features may require a bank account that is linked to fully utilize.

10. How do I pay for my PayTend account?

You can make a payment to your PayTend accounts by a variety of ways:

- Connecting a bank account to a debit card to a bank account or debit.

- Using direct deposit (if available in your region).

- In addition, you can use other payment methods, based on the location of your residence.

11. Can I withdraw cash from PayTend?

Yes, you can transfer funds from your account at PayTend to an account linked to a bank account or credit card. In general, withdrawals are processed fast particularly when you have verified accounts.

12. What should I do if forgot your PayTend login password?

If you have forgotten the password to your PayTend accounts you can simply click the “Forgot Password” option on the login screen. You’ll be asked to input your registered email address or number to get the password reset URL.

13. How can I get in touch with PayTend customer service?

PayTend accounts offers support to customers via a variety of channels:

- Support in-app: You can connect to live chat or send an inquiry directly through the application.

- Email support: You may contact the support team at PayTend accounts to get help.

- Support center site or app usually has an FAQ and troubleshooting section to help with frequently asked questions.

14. Is PayTend available worldwide?

PayTend accounts are accessible in a variety of countries however some features might only be available in certain areas. International cash transfers and bill payment are accessible in more than 100 countries. However, availability can vary based on local regulations and features offered.

15. What currencies do PayTend supports?

PayTend’s account can be used with multiple currencies, including well-known ones such as USD, EUR, GBP and many more. The availability of these currencies will depend on your location and the nature of the transaction (e.g. international transfers could require the conversion of currencies).

16. Can I utilize PayTend to purchase or sell cryptocurrency?

Certain users might be able to purchase or sell cryptocurrency through their PayTend accounts in accordance with their location and the platform’s capabilities for digital assets. Make sure to check the app for services for cryptocurrency in your region.

17. What should I do if suspect I have been a victim of fraud within the account of my PayTend accounts?

If you suspect fraudulent transactions in your account, promptly make contact with PayTend accounts customer service. They will assist you in securing your account, look into the issue and help prevent any further transactions that are not authorized.

18. Are there limits to the amount I am able to send and I can receive?

It is true that PayTend Accounts enforce limits on transaction, specifically for accounts that are not verified. Verified accounts are more restricted in both the sending and receiving of money. The limits can also differ according to your country of residence and payment method.

Conclusion

PayTend accounts offer a broad array of financial tools and services that help you manage your money more easily as well as safer and more efficient. When you’re looking to transfer money abroad, pay off bills, or utilize your prepaid credit card, the PayTend accounts provide a seamless platform to meet your financial requirements. If you have any further concerns or require assistance with your account, the help desk is always available to assist you.

Reviews

There are no reviews yet.